st louis county personal property tax receipt

1200 Market Street City Hall Room 109. See Property Records Tax Titles Owner Info More.

Collector - Real Estate Tax Department.

. Monday - Friday 800am - 500pm. 1200 Market Street City Hall Room 109. The Collectors office cannot accept payments for the wrong amount.

Payments postmarked after December 31 will be returned. May 16th - 1st Half Real Estate and Personal Property Taxes are due. Email protected 314 622-4105.

Monday - Friday 800am - 500pm. If you do not receive a form by mid-February please contact Personal Property at. Email protected 314 622-4105.

Payments can be made in person at 1200 Market Street Room 109. You may click on this collectors link to access their contact information. Assessments are due March 1.

Find Records For Any City In Any State By Visiting Our Official Website Today. How do I pay my personal property tax in St Louis County. Obtaining a property tax receipt.

Please visit one of our offices to establish your St. Property 7 days ago Collector - Real Estate Tax Department. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees.

The Collectors Office mails tax bills during November. You may pay personal and real estate taxes with one check but make sure to add them correctly and send the exact amount due. Property Just Now Obtain a Personal Property Tax Receipt - St.

August 31st - 1st Half Manufactured Home Taxes are due. If you did not file a Personal Property Declaration with your local assessor. Search Any Address 2.

If this concerns business personal property you will need to visit our Clayton location. Obtain a Personal Property Tax Receipt - St. Louis County Courthouse 100 N.

You may also pay your taxes by mail. Enter Name Search Risk Free. Please be sure that your payment is postmarked no late than December 31.

Louis City in which the property is located and taxes paid. Daly Collector of Revenue 1200 Market Street Room 109 St. Simply begin by writing in your name or another persons name and get brisk results.

Use your account number and access code located on your assessment form and follow the prompts. E-File Your 2022 Personal Property Assessment. Ad One Simple Search Gets You a Comprehensive St.

Monday - Friday 800am - 500pm. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

Ad Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. 4546 Lemay Ferry Rd. Property 7 days ago Collector - Real Estate Tax Department.

Contact the Collector - Real Estate Tax Department. 1200 Market Street City Hall Room 109. Louis County personal property account.

October 17th - 2nd Half Real Estate and Personal Property Taxes are due. Louis MO 63129. Send your payments to.

Your last paid personal property tax receipt if applicable Clayton. Ad Find Anyones Personal Property Records. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232.

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. St Louis County Personal Property Receipt.

Why St Louis County Business Owners Aren T Getting A Tax Break This Year Youtube

1910 St Louis Eldo Kc Rpo Cover L23384 Ebay

Sheriff St Louis County Courts 21st Judicial Circuit

Residential Building St Louis County Website

Lease Agreement Being A Landlord Lease Agreement Free Printable

Council Rules St Louis County Website

Sheriff St Louis County Courts 21st Judicial Circuit

Residential Building St Louis County Website

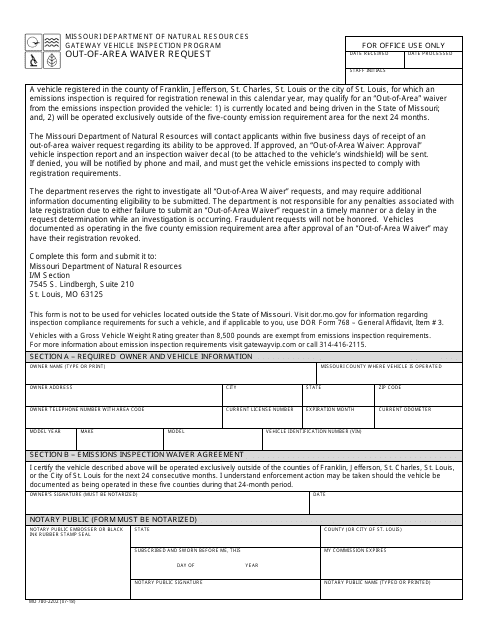

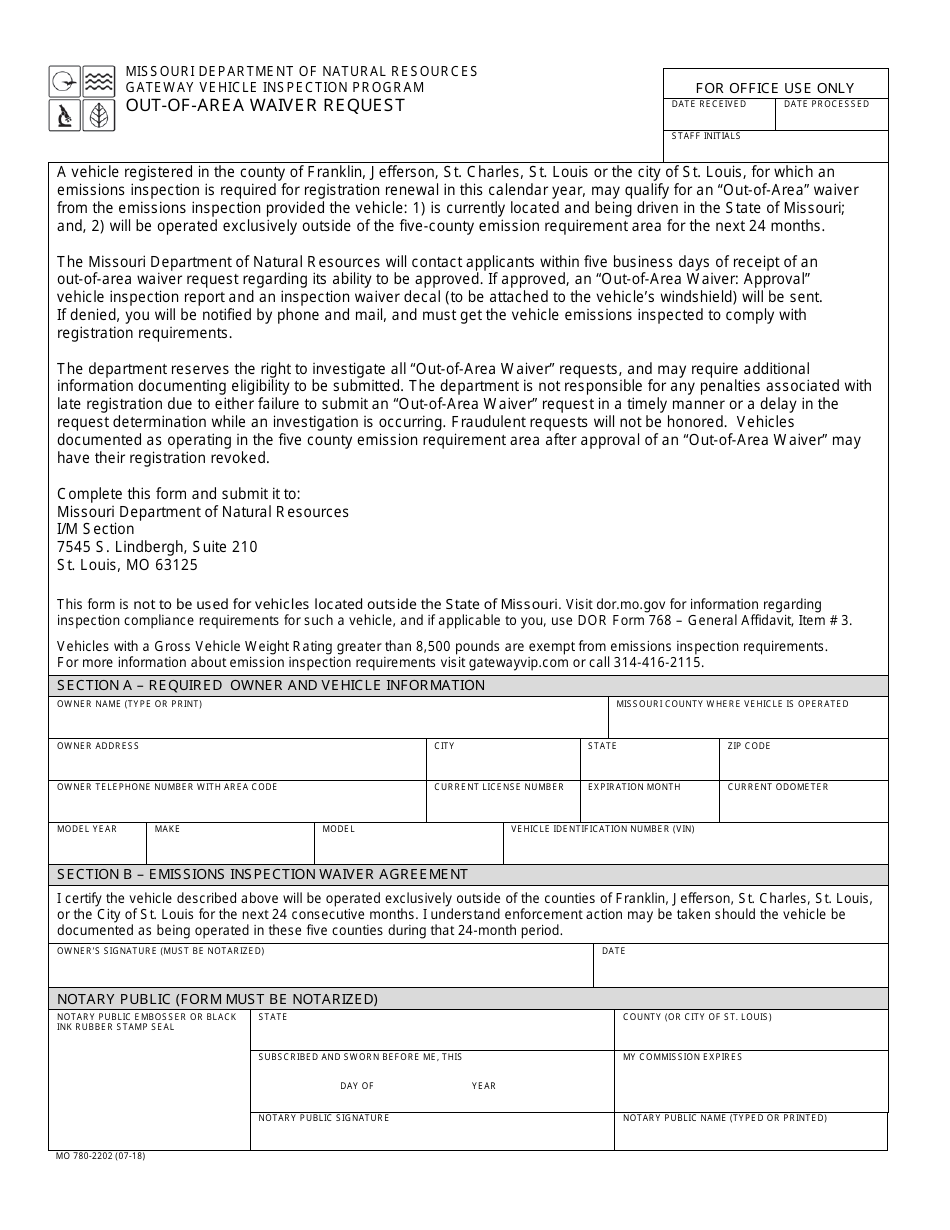

Form Mo780 2202 Download Fillable Pdf Or Fill Online Out Of Area Waiver Request Missouri Templateroller

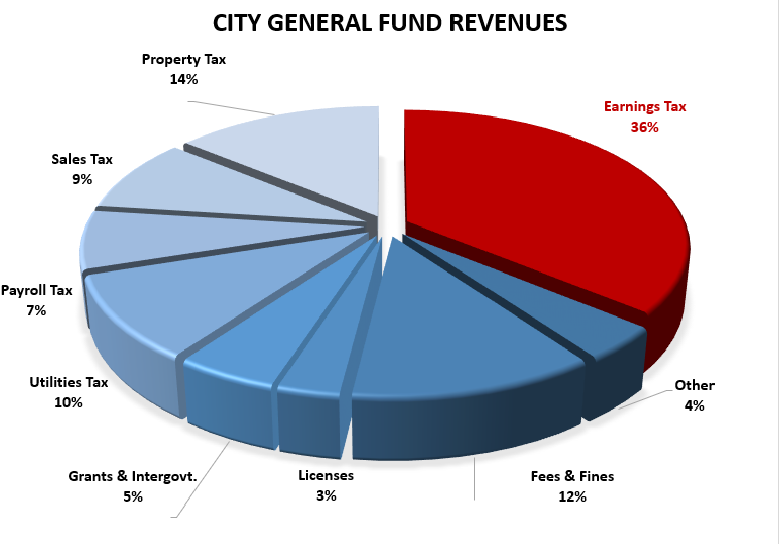

City Versus County Tax Sales Your St Louis Missouri Guide Tdd Attorneys At Law Llc

Form Mo780 2202 Download Fillable Pdf Or Fill Online Out Of Area Waiver Request Missouri Templateroller