does maryland have a child tax credit

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Credit for Income Taxes Paid to Other States Credit for Child and Dependent Care Expenses Quality Teacher Incentive Credit Long-Term Care Insurance Credit Credit for.

You must file this form electronically to claim business tax credits on Form 500CR.

. Form 502CR is used to claim personal income tax credits for individuals including resident fiduciaries. Earned Income Credit EIC Child and dependent care credit. Three years from the due date of the original tax year return including valid filing extensions.

2021 tax filing requirements for most people. Maryland Child Tax Credit. Check this box if you are claiming the Maryland Earned Income Credit with a qualifying child.

Youre required to file a return for 2021 if you have a certain amount of gross income. You may report the following tax credits on this form. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

Taxpayers with federal adjusted gross income of 6000 or less may claim a refundable credit of 500 for each qualifying child generally dependents under age 17. To learn more see Publication 501. Exemptions Standard Deduction and Filing Information.

One year from the final determination of the amended federal return or federal change whichever is later provided that the allowable refund is not more than the decrease in Maryland tax attributable to the federal change or correction. Maryland tax after credits Subtract line 26 from line 21 If less than 0 enter 0.

We Solve Tax Problems Tax Debt Irs Taxes Debt Relief Programs

Child Tax Credit 2021 8 Things You Need To Know District Capital

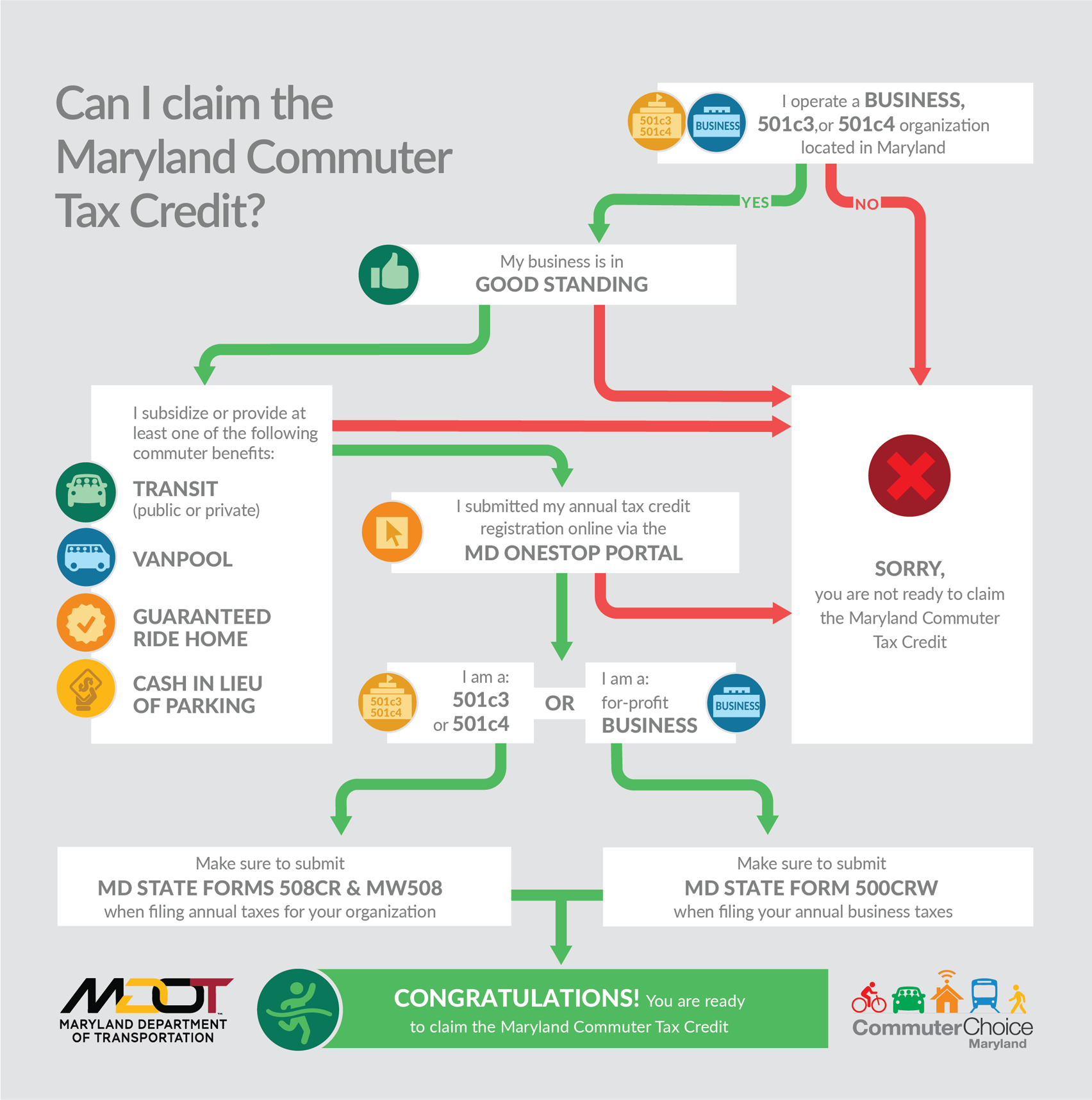

Maryland Commuter Tax Credit Mdot

Hogan And Legislative Leaders Announce Agreement On Tax Relief 2023 Spending Maryland Matters

Child Tax Credit Schedule 8812 H R Block

House Leaders Unveil Package To Slash Sales Taxes Expand Federal Work Opportunity Tax Credit Maryland Matters

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

General Assembly Passes 61 Billion Budget As Top Leaders Gather To Sign Tax Breaks Into Law Maryland Matters

The Child Tax Credit Payments Are Ending Some Families Say They Will Struggle Without Them The Washington Post

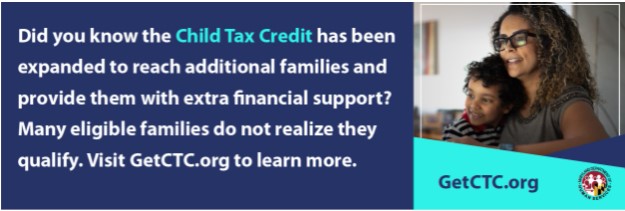

Tax Credit Available For Families With Children Dhs News

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

Maryland Improves Its Child And Dependent Care Tax Credit To Help More Families National Women S Law Center

Proposed Tax Cuts In Maryland Target Seniors Parents Dcist

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnn Politics

Irs Child Tax Credit Payments Start July 15

Tax Credit Available For Families With Children Dhs News

Maryland Historical Trust Sustainable Community Street View Historical